Profit Formula

The profit formula is used to calculate the amount of gain that has been made in a transaction. When the selling price of a product is greater than its cost price, a profit is earned. This makes up the basic profit formula which further helps in generating the percentage of profit that has been earned in a business or while making a financial deal. Let us learn more about the profit formula in this article.

What is Profit Formula?

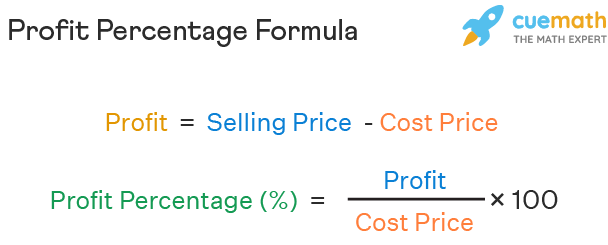

The profit formula helps in calculating the profit earned by selling a particular product, usually in a business, or, calculating the gain in any financial transaction. Profit is the difference between the total revenue (selling price) generated from the sales of goods or services and the total costs (cost price) incurred to produce or deliver them. Profit can be calculated when the selling price is greater than the cost price. Hence, the formula to find the profit is:

Profit = Selling Price (S.P.) - Cost Price (C.P.)

Where,

- The Cost Price of the product is the cost at which it was originally bought.

- The Selling Price of the product is the cost at which it was sold.

This formula represents the most basic calculation of profit, which is used to determine the financial outcome of any commercial enterprise. It should be noted that when the selling price is less than the cost price, there is a loss in the transaction.

Note: Direct costs are those expenses that are directly related to the production of goods or services, such as materials and labour. Indirect costs, on the other hand, are expenses that are not directly related to the production process but are necessary for the business, such as rent and other administrative expenses.

Different Profit Formulas

Since profit is a generic term, it is used for small and big transactions. For small-scale transactions, the basic profit formula given above is used. When bigger transactions take place in businesses, then terms like gross profit and net profit are used. These include terms like total sales, revenue, the overall profit percentage of a firm over a period of time, and so on. Some important formulas related to profit are given below:

| Type of Profit | Formulas |

|---|---|

| Profit | Revenue - Costs |

| Profit Percentage Formula | Profit/Cost Price) × 100 |

| Gross Profit Formula | Total revenue - Costs of goods sold |

| Net Profit Formula | Total revenue - Total costs - Indirect costs |

| Operating Profit Formula | Gross profit - Operating expenses |

| Profit Margin Formula | (Profit / Total revenue) × 100% |

| Gross Profit Margin Formula | (Gross profit / Total revenue) × 100% |

| Net Profit Margin Formula | (Net profit / Total revenue) × 100% |

| Operating Profit Margin Formula | (Operating profit / Total revenue) × 100% |

| Average Profit Formula | Total profits / Number of years of profit |

Profit Percentage Formula

Profit percentage (%) is the amount of profit expressed in terms of percentage. This profit is based on the cost price, hence, the formula to find the profit percentage is: (Profit/Cost Price) × 100.

Gross Profit Formulas

Gross profit is the profit that is obtained after deducting the cost of goods sold from its total revenue. The formulas that are related to gross profit are:

- Gross profit formula: Gross profit = Total revenue - Cost of goods sold

- Gross profit margin formula: Gross profit margin = (Gross profit / Total revenue) × 100%

- Gross profit percentage formula: Gross profit percentage = (Gross profit / Total revenue) × 100%

- Gross profit ratio formula: Gross profit ratio = (Gross profit / Net sales) x 100%

Net Profit Formulas

Net profit is obtained by subtracting the sum of total costs and indirect costs from total revenue. The formulas related to net profit are:

- Net profit formula: Net profit = Total revenue - total expense

- Net profit margin formula: Net profit margin = (Net profit / Total revenue) × 100%

- Net profit percentage formula: Net profit percentage = (Net profit / Total revenue) × 100%

- Net profit ratio formula: Net profit ratio = (Net profit / Net sales) x 100%

Examples Using Profit Formula

Example 1: A shopkeeper bought a pack of pencils for $25 and sold it for $30. Calculate the profit and the profit percentage.

Solution:

Cost price of the pack of pencils = $25; Selling price = $30

Using the profit formula, Profit = Selling Price - Cost Price

Profit = $30 - $25 = $5

Using the profit percentage formula,

Profit percentage = (Profit/Cost Price) × 100 = (5/25) × 100 = 20%

Therefore, the profit earned in the deal is of $5 and the profit percentage is 20%.

Example 2: On selling a table for $840, a trader makes a profit of $130. Calculate the cost price of the table.

Solution:

The selling price of the table = $840; Profit = $130

Using the formula of profit,

Profit = Selling Price - Cost Price

130 = 840 - Cost Price

Cost price = $710

Hence, the cost price of the table is $710.

Example 3: Mr. Ben bought a bag for $85 and sold it for $100. Do you think he made a profit in this transaction? If yes, then how much profit did he make?

Solution:

Cost price of the bag = $85; Selling price of the bag = $100. Since the selling price is more than the cost price, there is profit in the transaction.

Using the profit formula,

Profit = $100 - $85 = $15

Therefore, Mr. Ben made a profit of $15.

☛ Also check: Profit Calculator

FAQs on Profit Formula

What is Profit Formula?

When the Selling price of a product is greater than its Cost price, a profit is earned. This profit is calculated using the profit formula. In other words, the profit formula is used to calculate the profit earned by selling a particular product, usually in a business, or, to find the gain made in any financial transaction. The basic profit formula is expressed as, Profit = Selling Price - Cost Price

What is the Gross Profit Formula?

Gross profit is the profit that a business makes after the manufacturing and selling costs are subtracted from the total sales. The formula to calculate the gross profit is, Gross Profit = Total Sales (revenue) - Cost of goods sold.

What is the Net Profit Formula?

Net profit is the amount of money earned by a business after all the operating expenses, interest and tax expenses are deducted from the Gross profit. This means in order to find the net profit we need to know the gross profit. Therefore, the formula that is used to find the Net profit is, Net Profit = Gross profit - Expenses.

What is the Formula to Calculate the Profit?

The basic formula that is used to calculate the profit in a business or a financial transaction, is: Profit = Selling Price - Cost Price. Here,

- Cost Price (CP) of a product is the cost at which it was originally bought.

- Selling Price (SP) of the product is the cost at which it was is sold.

What is the Profit Percentage Formula using Selling Price?

The basic formula to find the profit percentage remains the same. However, the method varies according to the given values.

- When the selling price and the cost price of a product is given, the profit can be calculated using the formula, Profit = Selling Price - Cost Price. After this, the profit percentage formula that is used is, Profit percentage = (Profit/Cost Price) × 100.

- In other cases, when the selling price and the profit is given, we first find the Cost price using the formula, Cost price = Selling price - Profit. After this step, the profit percentage can be calculated using the formula, (Profit/Cost Price) × 100.

What is the Profit Percentage Formula?

Profit is always based on the Cost price. To calculate the percentage of profit earned from a particular sale, the formula that is used is:

Profit Percentage Formula = (Profit/C.P.) × 100

Where, C.P. = Cost Price of the article, i.e., the cost at which the article was originally bought.

What is the Profit Earned by Buying Chocolates at $20 each and selling them at $30 each?

Cost price = $20; Selling price = $30; Using the Profit Formula, Profit = Selling Price - Cost Price

Profit = $30 - $20 = $10

Therefore, the profit earned is $10

visual curriculum