Simple Interest Formula

Using the simple interest formula, one can calculate the percentage of the principal amount, charged by the lender or bank to the borrower for the use of its assets or money for a specific time period. In this section, we will be discussing the various aspects of the simple interest formula, and understand the variables involved.

What is the Simple Interest Formula?

Simple interest Formula is used to calculate the amount of interest charged on a sum at a given rate and for a given period of time. Let's explore further and have a look at the formula which will help in solving problems related to simple interest. Also, Simple interest = Amount paid - Principal. SI = A- P.

Simple Interest Formula

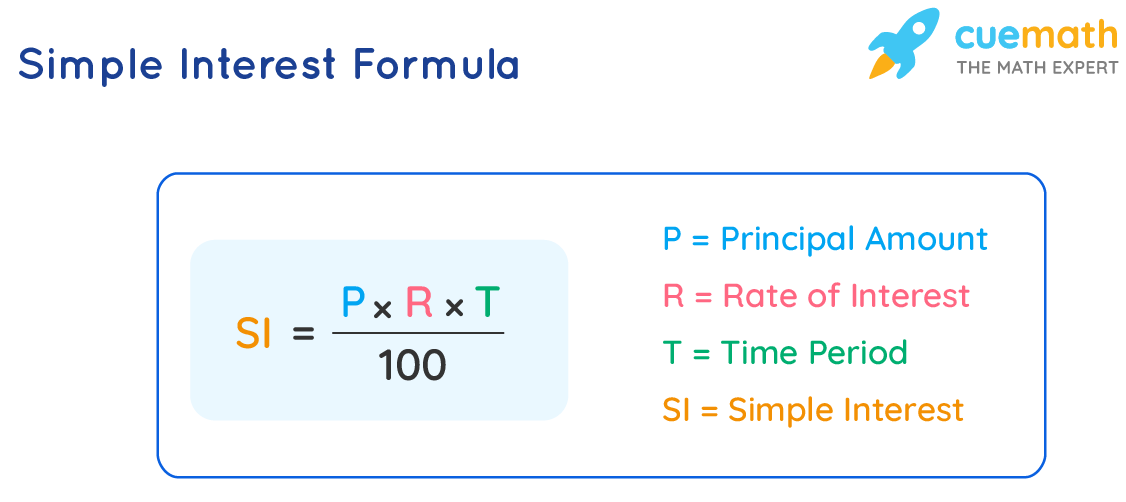

The simple interest for a given amount can be calculated by the following formula, Simple Interest = (P×R×T)/100

Where,

- P = Principal amount

- R = Rate of interest

- T = Time period

Applications of Simple Interest Formula

Given below are a few applications of the simple interest formula.

- mortgages

- bank deposits

- education loans

- car loans

- other consumer loans

Solved Examples Using Simple Interest Formula

Example 1: What is the simple interest on the principal amount of $12000 in 2 years, if the interest rate is 12%?

Solution:

To find: Simple Interest after 2 years.

Principle amount = $12000, r = 12%, t = 2(given)

Using the simple interest formula,

SI = (P × R ×T)/100

SI = (12000× 12 × 2)/100

SI = $2880

Answer: Simple interest after the end of 2 years will be $2880.

Example 2: James borrowed $600 from the bank at some rate per annum and that amount becomes double in 2 years. Calculate the rate at which James borrowed the money.

Solution:

To find: Interest rate

Principal amount = $600, Amount = $1200, Time = 2 year(given)

Using the simple interest formula,

Simple interest = Amount - Principal

Simple interest = $1200- $600= $600

Again using the simple interest formula,

SI = (P × R ×T)/100

600 = (600 × R × 2)/100

R = 50

Answer: James borrowed the money at 50% rate.

Example 3: Determine the simple interest on the principal amount of $15000 in 3 years, if the interest rate is 15%.

Solution:

To find: Simple Interest after 3 years.

Principal amount = $15000, r = 15%, t = 3(given)

Using the simple interest formula,

SI = (P × R ×T)/100

SI = (15000 × 15 × 3)/100

SI = 6750

Answer: Simple interest after the end of 3 years will be $6750.

FAQs on Simple Interest Formula

What is Simple Interest Formula?

Simple interest formula is one of the methods of calculating the interest on a certain amount. Simple interest is calculated by multiplying the interest rate by the principal amount and the time period which is generally in years.

What is 'n' in Simple Interest Formula?

In the simple interest formula, n refers to the time period or the term. It is mostly denoted as t and is generally expressed in years as the rate is per annum.

How to Use Simple Interest Formula When Term is Given in Months?

In case the simple interest has to be calculated for a period of a few months, then

- Step 1: Check for the values of the principal amount P, the rate of interest per annum R, and the time n (in months)

- Step 2: Put all the given values in the formula, Simple Interest for n months = (P × n × R)/ (12 ×100)

What are the Applications of Simple Interest Formula?

Simple interest is used in cases where the amount that is to be returned requires a short period of time. So, monthly amortization, mortgages, savings calculation, and education loans use simple interest.

visual curriculum